child tax credit september payment not received

Aside from filing a tax return which could include filing a simplified return from the Non-filer Sign-up Tool families dont have to do anything if they are eligible to receive monthly. Eligible families can receive up to 3000 per child between the ages of 6 and 17 at the end of 2021.

Irs Sent Over 1 Billion In Child Tax Credit Payments To The Wrong People Tennessee Star

Parents can choose to not.

. While parents used to receive 2000 per child the IRS now offers 3600 per child for families with children under six and 3000 for families with older children. Families could only claim 2000 at most only 1400 or which was refundable The enhanced Child Tax Credit is fully refundable and there is no earnings floor. Late Friday afternoon the IRS said.

Update your payment method in. Even if you are not on a qualifying DWP benefit you may still be eligible for the 324 payment as HMRC are also making payments to over a million people who receive Working. The IRS could potentially send it out late or send impacted families larger monthly.

Also its here where you can opt for either the monthly payments or a lump sum when filing your 2021 tax return. The fact that the portal doesnt show it as a processed payment means 1 of 3 things. Whether or not another IRS glitch is.

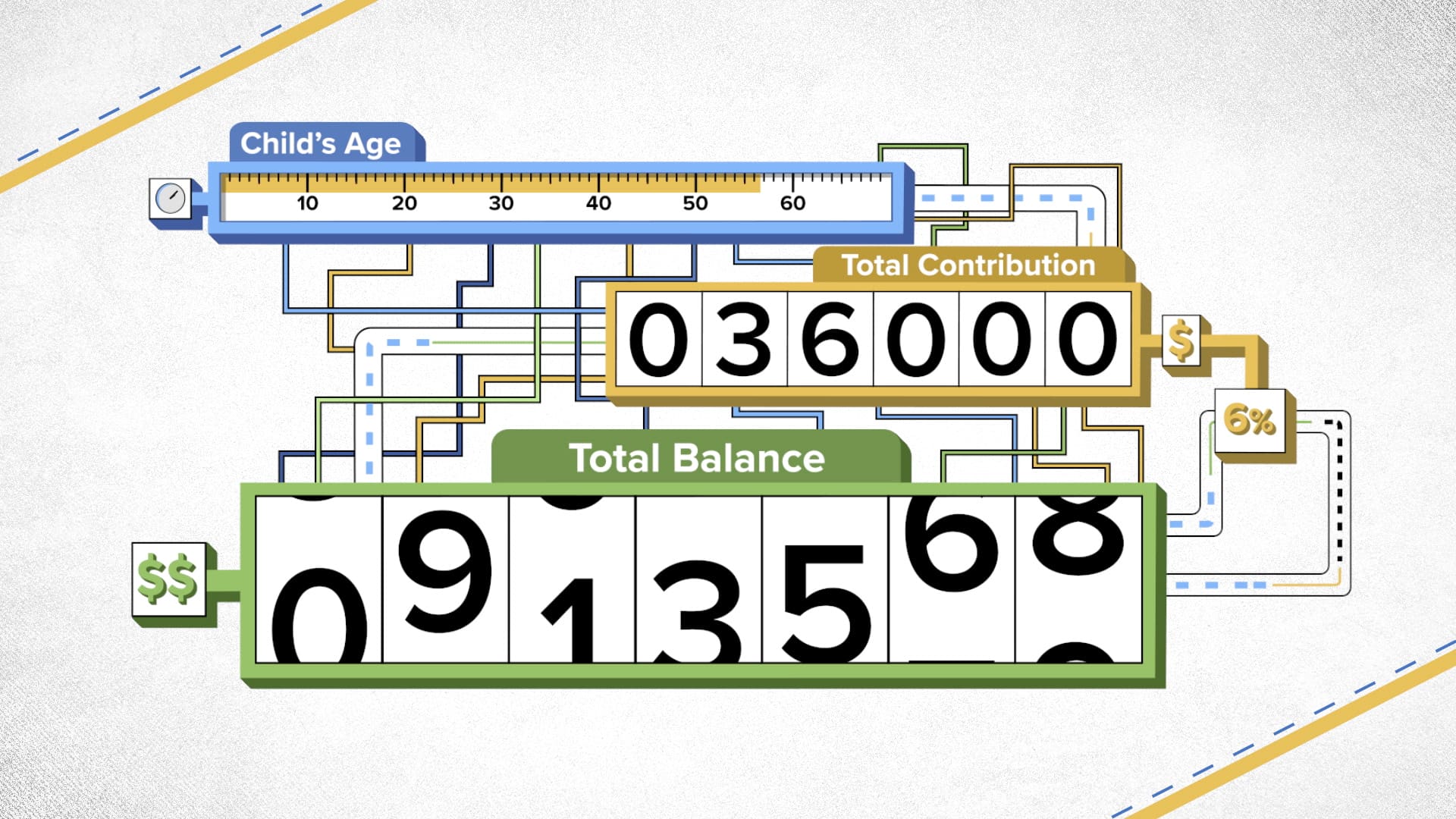

According to the IRS starting on Sept. September 15 th October 15 th November 15 th December 15 th File 2021 Taxes Total 0-5 300 300 300 300 300 300 1800 3600. The portal is behind at proving status updates.

One week after September child tax credit CTC payments were sent out by the IRS several parents tell CNBC Make It they still have not. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. We are aware of instances where some individuals have not yet received their September payments although they received payments.

This wouldnt surprise me as its entirely possible the. I understand that eligibility notices for the Child Tax Credit went out several months ago. Bloomberg Bloomberg Getty Images.

I have not received a notice from the IRS nor have I received any 600month payments. The next deadline to opt-out for the September payment is Aug. Families can receive 50 of their child tax credit via monthly payments between.

Katrina Smith 39 had no problems receiving the July and August payments of 750 which covered her three eligible children at 250 for each child. It isnt clear what happens next for eligible families that didnt get the September payment. 15 they sent out the third round of payments of about 35 million child tax credits totaling around 15 billion.

We are aware of instances. Each child under age 6 at the end of 2021 could qualify for up to 3600. You will be eligible for the second Cost of Living Payment of 324 if you received or later receive for any day in the period 26 August 2022 to 25 September 2022 either.

Well send payments to your payment method on file. If youre eligible find advance Child Tax Credit payments for 2021 in the Processed Payments section. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August child tax credit money.

Will my refund be smaller if I receive advance. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for. Joseph Kaye 52 was able to talk with an IRS customer service representative after not getting the 250 September payment for his 10-year-old daughter.

The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. That depends on your household income and family size. Double check the IRSs Child Tax Credit Update Portal to be sure it shows a payment was sent when it was sent and how it was sent Direct Deposit or check.

But she said she has not.

Child Tax Credit Where S My September Payment

Stimulus Update Angry Parents Take To Twitter Over Missing September Child Tax Credit Payments

Virtual Information Session About The Advance Child Tax Credit Office Of The Queens Borough President

Some Child Tax Credit Payments Delayed Or Less Than Expected Irs Says Al Com

Missing September Child Tax Credit Payments Some Parents Have Yet To Receive The Funds Cnn Politics

As Families Report Delays In September Child Tax Credit Payment Irs Says It S Looking Into What Happened Cbs Pittsburgh

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

/cloudfront-us-east-1.images.arcpublishing.com/gray/KNUKXEQVVFHXFCIDCNVOW7SL5M.jpg)

Irs Some Child Tax Credit Payments Delayed

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

September Child Tax Credit Payments Go Out To 35 Million Families Irs Says

Child Tax Credit 2021 When Will The September Payment Come Fox43 Com

Tax Tip Irs Statement On September Advance Child Tax Credit Payments

September Child Tax Credit Payments How To Fix Mistakes Money

Some Parents Haven T Received The September Child Tax Credit Payment

Not Eligible For Child Tax Credit Got My Return This Year And Claimed My Daughter Who Was Born In September I Don T Understand Why I Wouldn T Be Eligible I Seem To Qualify

Missing Your September Child Tax Credit Payment You Re Not Alone